Last updated on: February 3, 2025

Singapore Cost of Living 2025: A Guide for Singles and Those Living Alone

Real Data from a Survey Responses

The cost of living is one of the hottest topics around the globe. Before moving to any country, understanding its cost of living is crucial.

For many foreigners considering a move to Singapore, knowing how much it costs to live here is a top priority. Every aspect of daily life comes with a price tag, from housing and food to transport and entertainment. To help expats plan better, I conducted a survey of nearly 150 participants via a Google Form, gathering real data on what it truly costs to live in Singapore in 2025.

This article breaks down the findings to give you a clear picture of what monthly expenses single individuals or those living alone in Singapore can expect.

TL;DR

- Overall Spend: EP holders living alone spend around S$2,660/month, while S Pass holders spend about S$1,603/month.

- Accommodation Preference: 82.93% of EP holders stay in separate rooms (46.34% in common rooms and 36.59% in master rooms), while 58% of S Pass holders share rooms.

- Dining Out: EP holders spend S$438/month, more than double the S$204/month spent by S Pass holders.

- Utilities & Groceries: Compared to EP holders, S Pass holders spend less on utilities (S$25 vs. S$52) and groceries (S$169 vs. S$234).

The audience of the survey

Pass Type

The survey received 142 responses. Among them, 93 are EP (or DP of an EP) holders, 30 are S Pass holders, and 15 are Singapore PR holders. I only consider these 138 (93+30+15) responses for the analysis.

-

EP (or DP of an EP) 93

EP holders are foreign professionals, managers, and executives with higher salaries and specialised skills

-

S Pass 30

S Pass holders are mid-level skilled workers in industries like construction, manufacturing, healthcare, and services.

-

Singapore PR 15

Note: EP holders are foreign professionals, managers, and executives with higher salaries and specialised skills. S Pass holders are mid-level skilled workers in industries like construction, manufacturing, healthcare, and services.

nationality

I shared the survey link in a community WhatsApp group where all participants are Sri Lankans working in Singapore. Additionally, some of my Indian and Indonesian friends working in Singapore also responded to the survey. As a percentage, close to 95% of the respondents are Sri Lankans.

All amounts are in Singapore dollars.

Singapore Dollar (SGD)

-

USD 0.74

-

INR 64.10

-

LKR 219.30

The analysis is divided between EP and S Pass holders to reflect the distinct lifestyle differences observed in the survey results, providing a clearer understanding of their spending patterns.

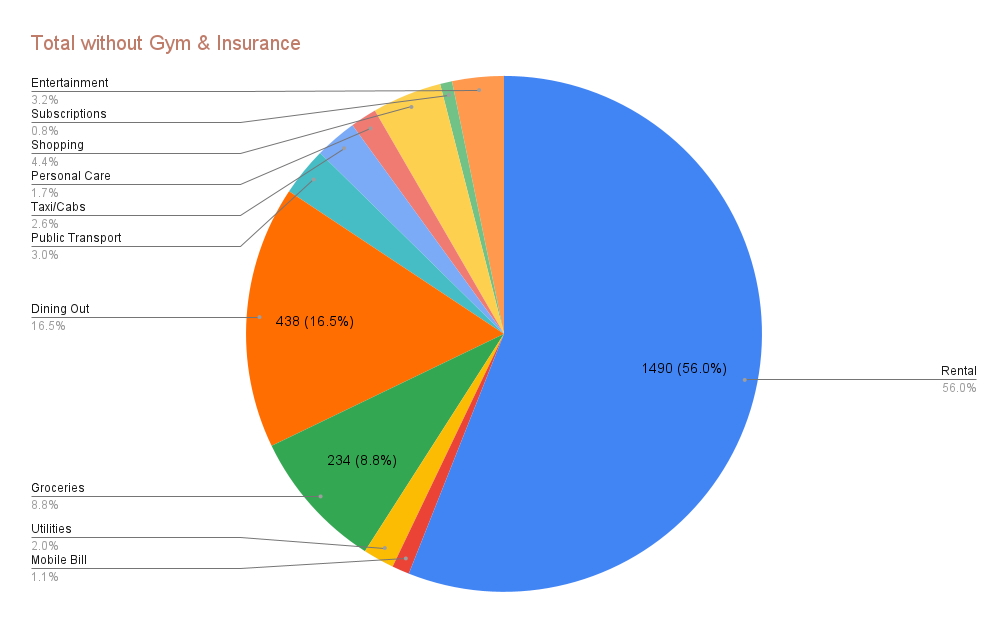

1. Average Expenses for EP Holders Living Alone in Singapore

The following table provides an overview of the average monthly expenses for Employment Pass (EP) holders who are single or living alone in Singapore. These averages are based on survey responses.

-

Rental S$ 1490

-

Mobile Bill S$ 29

-

Utilities S$ 52

Electricity, water, and internet

-

Groceries S$ 234

Vegetables, fruits, meat, and toiletries

-

Dining Out S$ 438

Eating at restaurants or hawker centers

-

Public Transport S$ 81

Buses and MRT rides

-

Taxi/Cabs S$ 70

Ride-hailing services like Grab

-

Personal Care S$ 44

Haircuts and spa

-

Shopping S$ 116

Clothing and footwear

-

Subscriptions S$ 20

Netflix, Spotify, YouTube Premium etc.

-

Entertainment S$ 86

Movies, sports, or social outings

-

Total without Gym & Insurance S$ 2660

-

Gym Fee S$ 77

30 out of 41 respondents (73%) do not pay for a gym

-

Insurance S$ 144

28 out of 41 respondents (68%) do not pay for insurance

-

Total with Gym & Insurance S$ 2881

The cost of living differs based on individual lifestyle choices. An Employment Pass (EP) holder living alone without a family typically needs between S$2,500 and S$3,000 monthly to cover basic and lifestyle expenses.

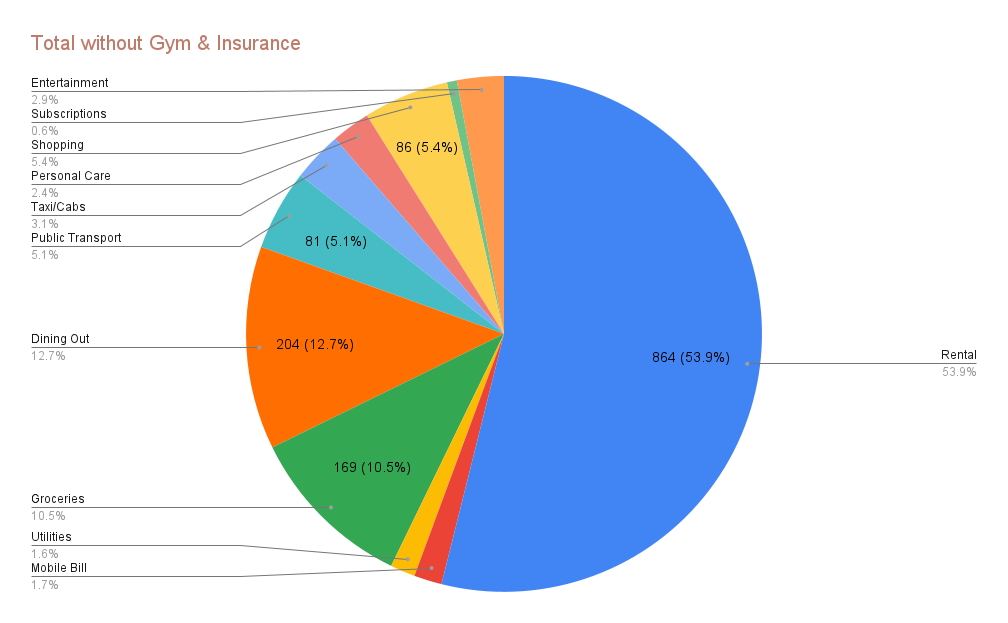

2. Average Expenses for S Pass Holders Living Alone in Singapore

The following table provides an overview of the average monthly expenses for S Pass (SP) holders who are single or living alone in Singapore. These averages are based on survey responses.

-

Rental S$ 864

-

Mobile Bill S$ 28

-

Utilities S$ 25

Electricity, water, and internet

-

Groceries S$ 169

Vegetables, fruits, meat, and toiletries

-

Dining Out S$ 204

Eating at restaurants or hawker centers

-

Public Transport S$ 81

Buses and MRT rides

-

Taxi/Cabs S$ 50

Ride-hailing services like Grab

-

Personal Care S$ 39

Haircuts and spa

-

Shopping S$ 86

Clothing and footwear

-

Subscriptions S$ 10

Netflix, Spotify, YouTube Premium etc.

-

Entertainment S$ 47

Movies, sports, or social outings

-

Total without Gym & Insurance S$ 1603

-

Gym Fee S$ 70

75% of the respondents do not pay for a gym

-

Insurance S$ 139

25% of the respondents do not pay for insurance

-

Total with Gym & Insurance S$ 1812

The cost of living differs based on individual lifestyle choices. A S Pass (SP) holder living alone without a family typically needs between S$1,500 and S$1,850 monthly to cover basic and lifestyle expenses.

Accommodation Preferences: EP vs. S Pass Holders

EP Holders

- 36.59% stay alone in a master room

- 46.34% stay alone in a common room, which is the most common choice among EP holders.

- 14.63% live alone in an entire unit without sharing

S Pass Holders

- 58% share a room with someone

- 27% stay alone in a common room

The Master Bedroom has an attached bathroom. The bathroom in the Common Room is located outside the room and may be shared with others.

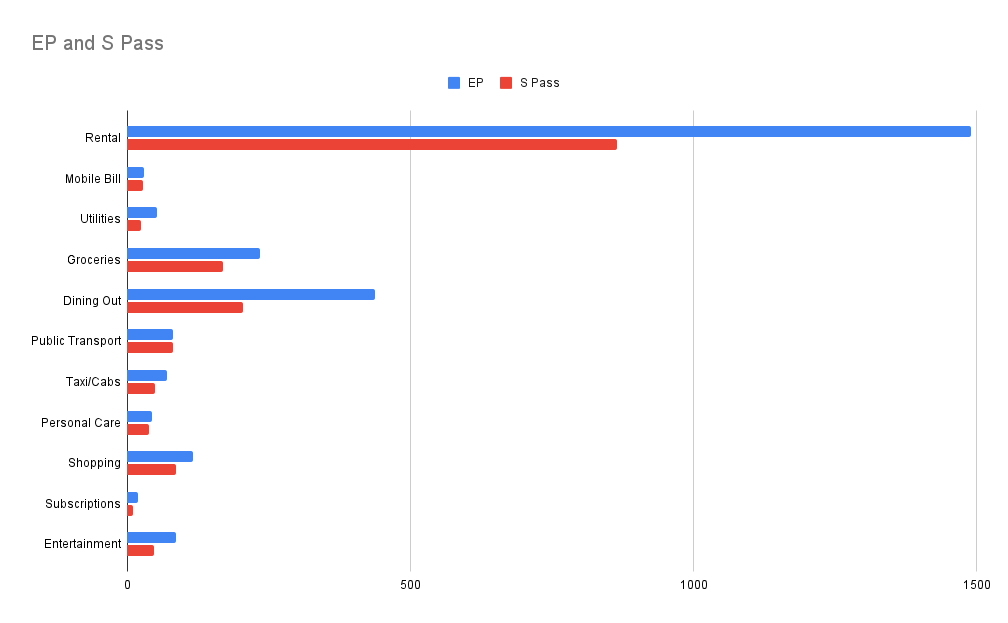

Lifestyle Differences: EP vs. S Pass Holders Living Without Family

- Rental: EP holders pay more (S$1490 vs. S$864).

- Utilities: Higher for EP holders (S$52 vs. S$25).

- Groceries: EP holders spend more (S$234 vs. S$169).

- Dining Out: EP holders spend double (S$438 vs. S$204).

- Transportation: Similar public transport costs (S$81), but EP holders spend more on taxis (S$70 vs. S$50).

- Personal Care & Shopping: EP holders spend more (S$44 vs. S$39 and S$116 vs. S$86).

- Subscriptions & Entertainment: EP holders spend more (S$20 vs. S$10, S$86 vs. S$47).

That’s it for today, guys. Thank You for Reading! I hope you found this article informative and useful.

If you think it could benefit others, please share it on your social media networks with friends and family who might also appreciate it.

If you find the article useful, please rate it and leave a comment. It will motivate me to devote more time to writing.

If you’d like to support the ongoing efforts to provide quality content, consider contributing via PayNow. Your support helps keep this resource thriving and improving!